Is it a sellers’ market?

How quickly is the market moving?

What are the pricing trends?

Do mortgage interest rates affect sellers?

How does my home compare to others on the market?

The latest national real estate market indicators provide the answers to those questions.

Is now the time to sell your home? Let’s find out!

Hello Central Kentucky. This is the National Real Estate Market Watch for January 2024 brought to you by CENTURY 21 Simpson & Associates. We understand that the process of selling a home can be stressful and uncertain. That’s why we’re here, to provide actionable insights for home sellers.

Prefer a video format? Visit our YouTube Channel: https://www.youtube.com/@century21simpsonassociates

Months Supply of Inventory

This indicator will tell us the balance between supply and demand in the real estate market and whether the current market favors buyers or sellers.

Months Supply of Inventory measures how long the current inventory of properties available for purchase would last at the current rate of sales if no new properties came on the market.

Six months of inventory represents a balanced market, favoring neither buyer nor seller. When Months Supply of Inventory is below 6 months, it is considered a sellers’ market.

November marked the 19th consecutive month of month-over-month increases in months supply of inventory.

With 1.13 million homes available for purchase in November, the months supply of inventory fell to 3.5 months. That’s a 2.8% decrease over the previous month and 6.3% higher than a year ago.

The average months supply of inventory by year shows that it has been a sellers’ market since 2012.

For context, over the past decade, the average months supply of inventory was 3.9 months.

At 3.5 months supply of inventory, the market continues to favor sellers. There are simply not enough homes on the market to meet buyer demand.

Existing Home Sales

This indicator tells us about the pace of the market. A faster pace favors sellers.

Existing home sales is the total number of all the properties whose sales contracts were completed, or closed, during the month.

At 3.82 million, home sales increased for the first time in 5 months. In November, home sales were up 0.8% compared to the previous month and down 7.3% compared to the previous year. This represents the smallest year-over-year decline since April 2022.

According to National Association of REALTORS Chief Economist Lawrence Yun, when looking at the year-over-year decrease, “The latest weakness in existing home sales still reflects the buyer bidding process in most of October when mortgage rates were at a two-decade high before the actual closings in November. A marked turn can be expected as mortgage rates have plunged in recent weeks.”

Sellers who are ready to list their homes should be encouraged that despite lower sales, buyer demand still exceeds supply. As rates moderate, more buyers will re-enter the market.

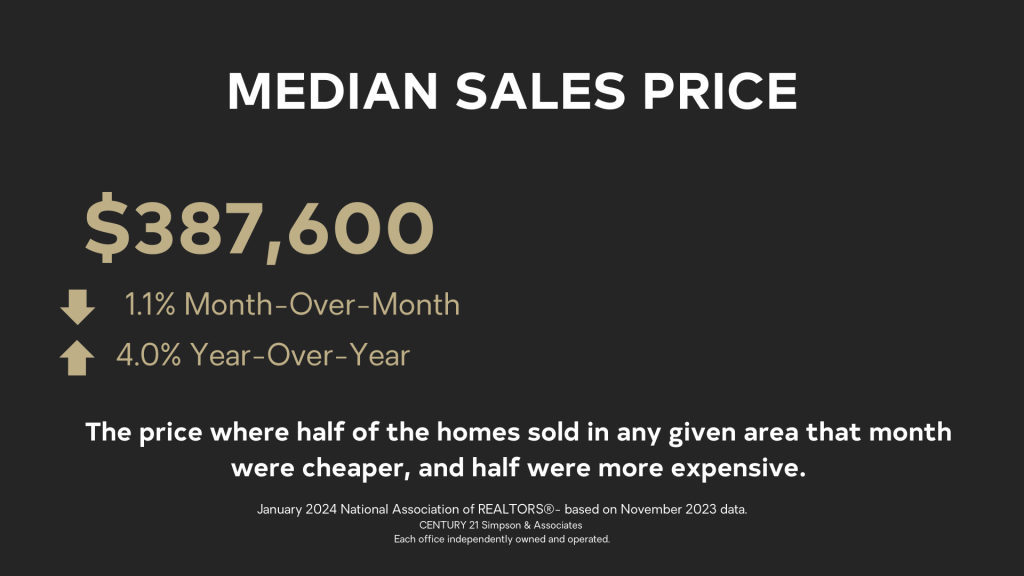

Median Sales Price

This indicator helps us understand the core pricing trends of the market.

The median is the price where half of the homes sold in any given area that month were cheaper, and half were more expensive.

The National Association of REALTORS predicted a median home price of $386,300 for the end of 2023. November’s median sales price is within less than $1,000 of that prediction.

The median sales price fell 1.1% to $387,600 compared to last month yet it’s up 4.0% over last year.

Limited construction in the last 20 years and home sellers holding onto their low mortgage rates has contributed to a shortage of homes for sale. When supply is low and demand is high, economics tells us prices will increase.

Lawrence Yun, National Association of REALTORS Chief Economist said, “Home prices keep marching higher. Only a dramatic rise in supply will dampen price appreciation.”

Sellers can still capitalize on historically high prices and continued buyer demand.

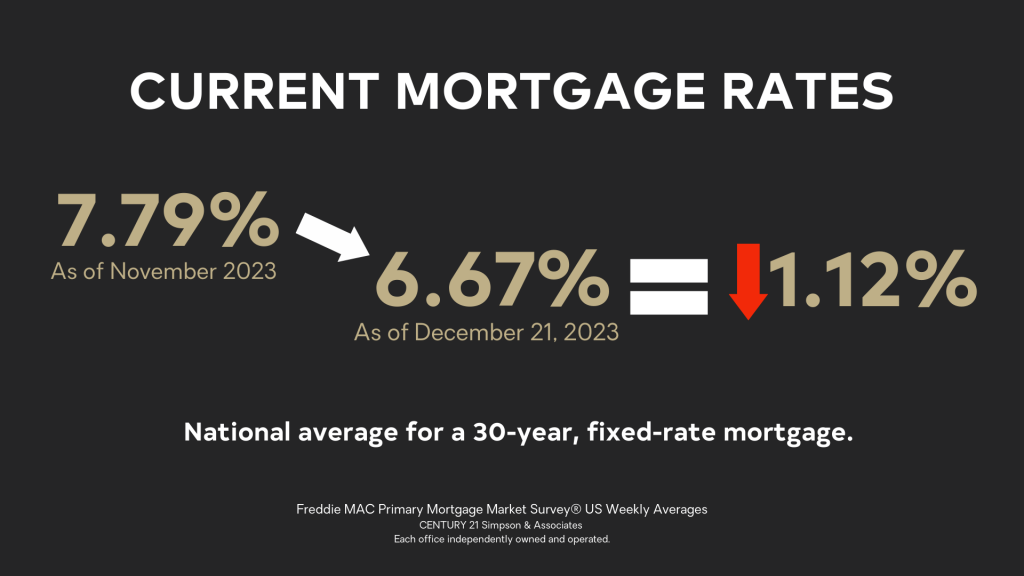

Current Mortgage Rates

As a seller, mortgage interest rates are important because they determine the size of the pool of potential buyers and the speed of the selling process.

Mortgage interest rates vary by area, lender, and type of financing. For reference, we look at the national rate for a 30-year fixed-rate mortgage.

Rates have fallen from 7.79% to 6.67% as of December 21st. That’s a drop of 1.12%.

Because a 1% change in interest rate is equivalent to a 10% change in home price, buyers feel they are paying 10% less for homes today than they were at the end of October.

Jessica Lautz, National Association of REALTORS Deputy Chief Economist and VP of Research says, “Will it be a traditional Spring real estate market, or will it start to heat up in the Winter months as rates decline? Let’s also hope the lower mortgage interest rates translate into stronger homebuilder activity, as inventory will be needed as buyers move from the sidelines. For serious buyers, the time is now to get your financial house in order, find a REALTOR® and start your research.”

Sellers benefit because buyers tend to resume their search when rates fall. Lower mortgage rates are encouraging to buyers. Those who had felt priced out of the market are expected to return—increasing competition.

Days on Market

The Days on Market indicator helps us determine if our pricing is correct or if there is some other market resistance, potentially leading to reduced buyer interest and negotiating power.

The Days on Market is the average number of days that sold listings were on the market. Those days are calculated from the day a property is listed until it goes under contract. If there were any days the property was off the market, then those days are subtracted.

Days on Market is at 25 days, which is up 2 days from last month’s data.

The average number of offers per listing held nearly steady at 2.6 offers.

Affordability is impacting the first-time home buyer market—the share fell from 29% in September 2022 to 27% in September 2023, but smart first-time buyers seized the opportunity of reduced competition, as their percentage increased from 28% in October to 31% in November.

As rates fall and competition increases, sellers can expect more buyers to act fast and be ready with strong offers.

Let’s recap what sellers need to know.

- Prices in November were up 4% compared to last year. Tight inventory and strong buyer demand could lead to more price increases over time.

- Tight inventory continues to be a major factor fueling this market. With 1.13 million or 3.5 months of listings on the market, more buyers are expected to enter the market and prices will likely rise.

- Homes were on the market for 25 days in November. As rates fall and competition increases, sellers can expect more buyers to act fast. If you have a home to sell and were feeling like you missed your window, don’t miss this one!

- Rates have dropped to the mid-6% range. Buyers who were priced out of the market this fall are expected to return—increasing competition.

Timing the market is nearly impossible! The best we can do is read and react to the data available, and it’s sending a clear message: If you’re ready to sell, it’s best to act now!

With falling rates, buyer demand is expected to rise. Tight inventory means listings are poised to be in demand.

Let us or have your REALTOR run the numbers based on the market and see if that achieves your financial goals.

Call our Frankfort ((502) 223-1600) or Lexington ((859) 455-3321) Offices or reach out to one of our real estate agents if you have any questions about the current real estate market.

If you are interested in comparing the indicators in this national market update with those of Central Kentucky counties, check out our local real estate market update videos for Frankfort-Franklin County, Georgetown-Scott County, Lawrenceburg-Anderson County, Lexington-Fayette County, Nicholasville-Jessamine County, and Versailles-Woodford County.

To watch our local updates, visit our YouTube Channel: https://www.youtube.com/@century21simpsonassociates

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link